Selling Isn’t Enough: Cash Flow Transparency Drives eCommerce Success in Vietnam

Vietnam’s eCommerce boom attracts global players, but true success depends on transparent, compliant cash flow management

Vietnam’s eCommerce market, with its young population, high internet penetration, and impressive growth rate, has long been an attractive destination for global giants. The competition for market share goes far beyond aggressive marketing campaigns, optimized user experiences, or efficient supply chains. Behind the dazzling growth figures lies a decisive factor that determines a company’s sustainable success: transparency and compliance in cash flow management.

Many international companies entering Vietnam tend to focus all their efforts on “sales” - how to attract users and grow order volume. However, they soon realize that operating complex cash flows, transacting with thousands of merchants and millions of end-users in Vietnam, is an entirely different challenge - one that carries significant legal and operational risks.

Transparent cash flow: A prerequisite for sustainable growth

With millions of transactions every day, cash flows running through eCommerce platforms are not just revenue; they are under strict scrutiny by regulators aiming to build a healthy digital economy and prevent tax evasion.

At this point, international regulations and standards become critical:

-

FATF (Financial Action Task Force): Vietnam adheres to FATF recommendations on anti-money laundering (AML) and counter-terrorism financing. Without proper controls, eCommerce platforms risk becoming channels for illicit financial flows.

-

AML (Anti-Money Laundering): AML laws require businesses to implement KYC/eKYC for customer identification, KYB for merchant due diligence, and ongoing monitoring of unusual transactions to detect and report suspicious activity.

-

CRS (Common Reporting Standard): CRS requires cross-border sharing of financial account information to combat tax evasion. Businesses must ensure accurate reporting when requested.

Ignoring these regulations exposes businesses to heavy penalties, suspension of operations, and serious reputational damage.

The need for a trusted local “navigator”

Faced with Vietnam’s financial regulations and legal complexities, achieving 100% compliance independently is a costly and resource-intensive task for international eCommerce companies. This is where the role of a local payment partner becomes vital.

However, not every partner can meet these high standards. International eCommerce players need more than just a payment provider; they need a trusted “navigator” equipped with: A secure and stable technology platform, Fast and accurate reconciliation capabilities, and Deep legal and regulatory expertise for consultation and support.

9Pay: A strategic partner for conquering Vietnam’s market

Entering Vietnam is a long-term race for global eCommerce platforms. Beyond business strategies, companies need a solid financial and regulatory foundation to succeed.

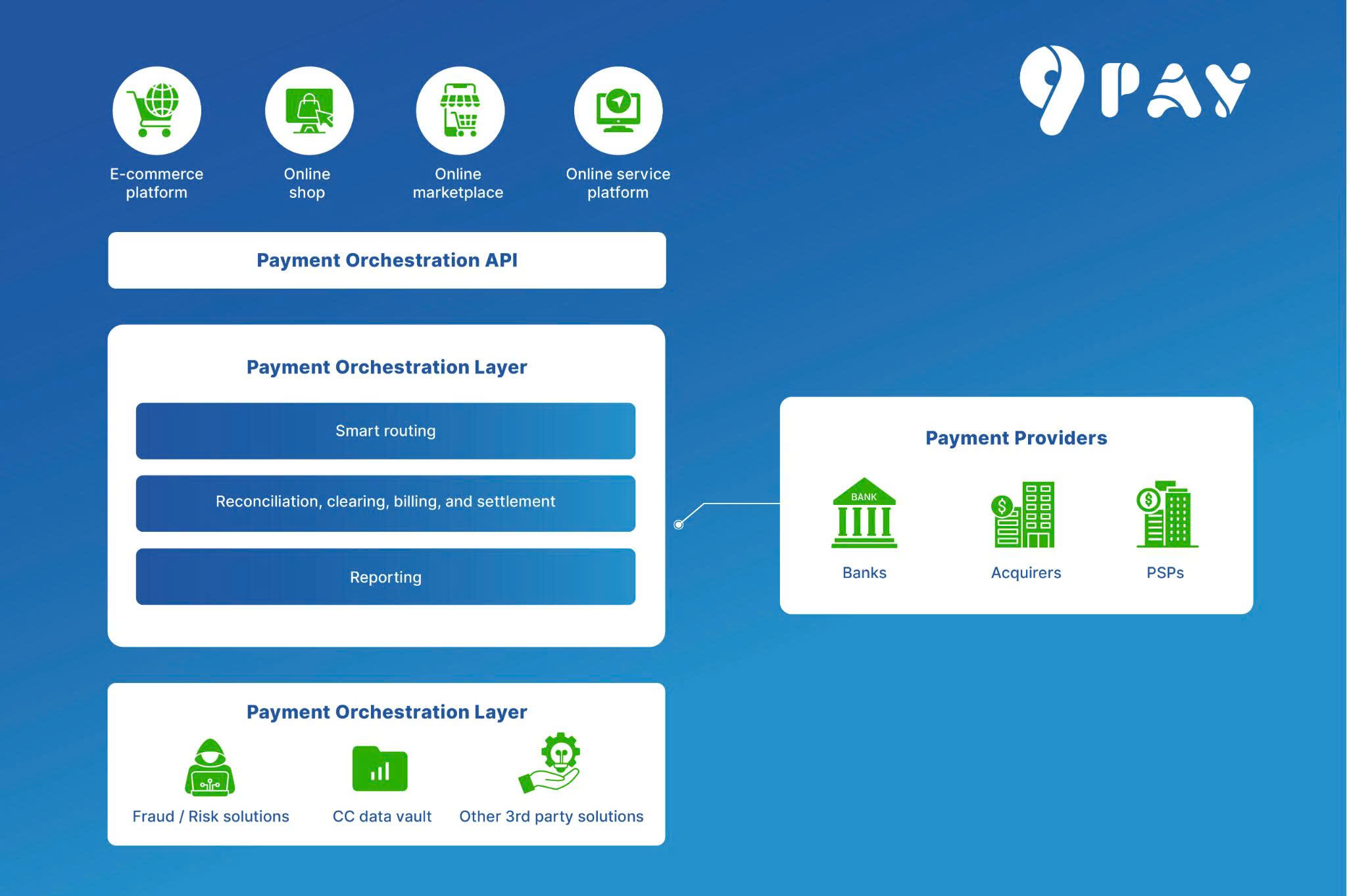

Understanding this, 9Pay has built a comprehensive payment ecosystem that integrates technology with legal expertise, easing the burden of cash flow transparency for international businesses entering Vietnam.

Mr. Lê Tuấn Anh, Business Director at 9Pay, shared: “For Vietnam’s eCommerce, cross-border payments remain a difficult challenge. Recognizing this, 9Pay delivers a T+0 cross-border payment solution, enabling faster settlement and seamless QR-based payments. Fast, secure, and transparent, making cross-border transactions smoother than ever.”

Licensed by the State Bank of Vietnam and compliant with international security standards, 9Pay ensures every transaction is safe. Our automated reconciliation system enables precise and transparent cash flow management, while our legal experts provide ongoing support for AML, FATF, and tax compliance.

With robust infrastructure and deep regulatory expertise, 9Pay is ready to help international eCommerce enterprises overcome cash flow transparency barriers and unlock growth in Vietnam.