Cross-border QR payments: A driving force for the global cashless economy

Cross-border QR payments drive the global cashless economy, breaking barriers and boosting Vietnam’s fintech growth.

Cross-border QR payments are revolutionizing the global cashless economy. QR codes are not just convenient tools; they are the key factor breaking down traditional financial barriers, creating a seamless and efficient flow of transactions. This trend is gaining strong momentum in Vietnam, highlighting the crucial role of Fintech companies.

Cross-Border QR Codes: The Game-Changer

Previously, cross-border payments were often complex, costly, and time-consuming. Traditional methods like international bank transfers or credit card usage faced limitations such as high transaction fees, unfavorable exchange rates, and security risks. The QR code emerged as a groundbreaking solution, addressing these challenges with simplicity and efficiency.

The primary advantage is convenience. Tourists can simply use their familiar e-wallet app to scan a QR code and pay at merchants abroad, eliminating the need to exchange cash or carry multiple physical cards. This not only improves the shopping experience but also minimizes the risk of loss.

Moreover, cross-border QR payments contribute to financial inclusion. In many developing countries where traditional banking penetration is low, e-wallets and QR payments have become a key channel for financial access. By connecting national payment systems through QR codes, these countries can create a widespread transaction network, boosting commerce and sustainable economic development.

A prime example is the bilateral and multilateral cooperation among central banks in the ASEAN region. The linkage of Vietnam's QR payment system with those of Thailand, Cambodia, and Laos, and soon other countries, is creating a common economic space where currencies can circulate more easily and efficiently.

Challenges and Solutions

Despite the immense potential, realizing a comprehensive cross-border QR payment system requires us to address several challenges:

-

Security: Ensuring the safety of users' personal and financial information is paramount. Systems must be equipped with advanced encryption technologies and effective anti-fraud measures.

-

Legal Frameworks: Each country has its own set of regulations regarding payments and foreign exchange management. Harmonizing these regulations to create a fair and transparent playing field is a complex task that requires close coordination between governments and financial institutions.

-

Market Adoption: For cross-border QR payments to become mainstream, they need widespread acceptance from both consumers and businesses, from large retail chains to small shops.

9Pay's Foundational Role in Vietnam's Cross-Border Payment Flow

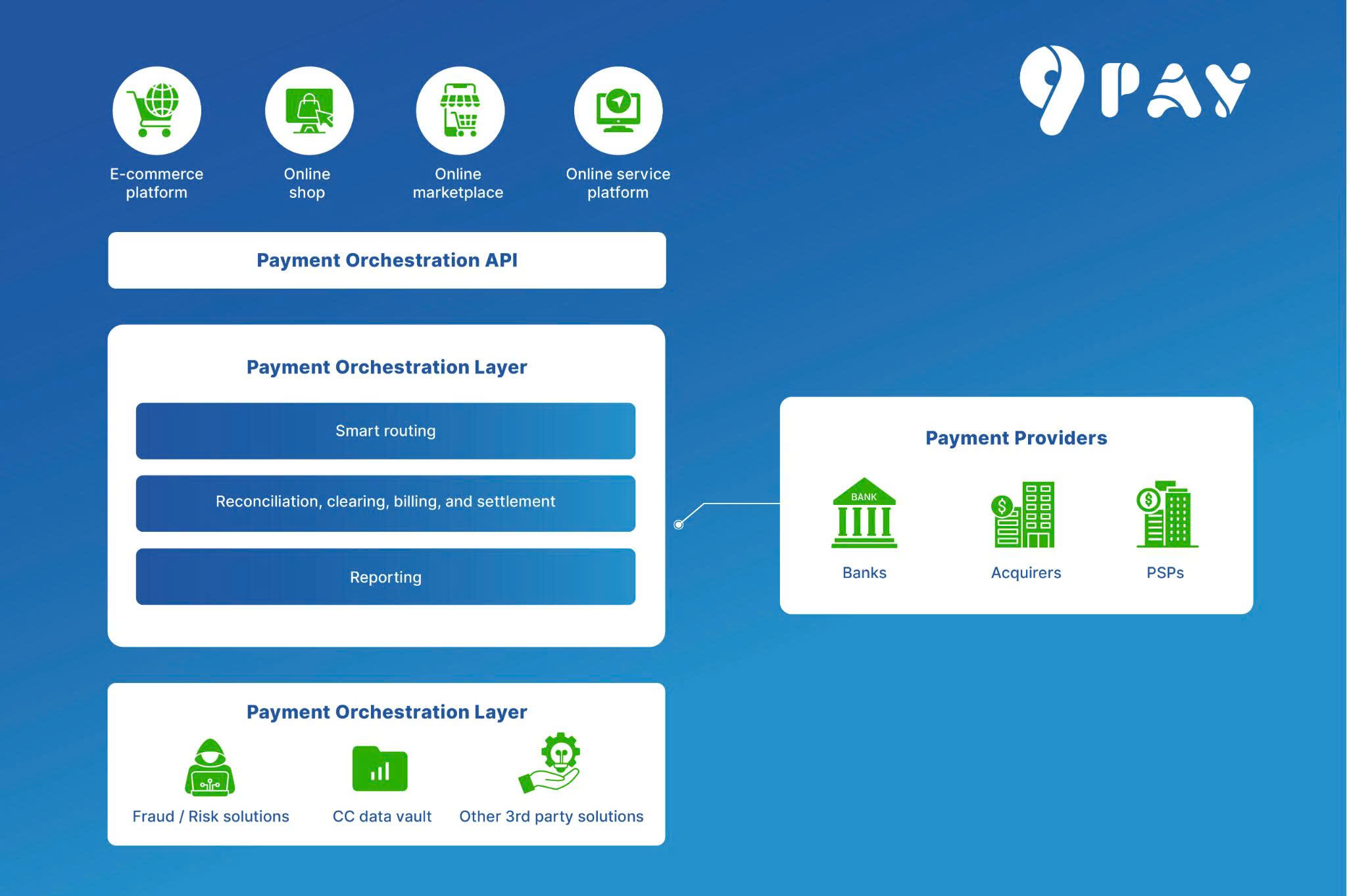

In this context, Vietnamese Fintech companies are rising, playing a vital role in promoting this trend. 9Pay has developed cross-border QR solutions to address these challenges and benefit the domestic economy.

9Pay's solution is built on a solid platform licensed by the State Bank of Vietnam, meeting the market's stringent requirements for infrastructure and legal systems. The robust infrastructure, which adheres to international standards, is ready to expand cross-border QR payments to meet the significant demand from foreign visitors to Vietnam.

In a segment of the VTV's Made in Vietnam series, Mr. Hoang Tuan Anh, Head of Business at 9Pay, shared: "9Pay has developed a cross-border QR payment solution, enabling international users to pay seamlessly in Vietnam with their existing wallets, supporting multi-currency payments, optimized FX rates, and flexible policies."

In the near future, 9Pay will continue to expand its network of cross-border QR payment points to serve a wider range of customers.

Significant Benefits for the Vietnamese and Global Economies

The growth of cross-border QR payments, with the participation of companies like 9Pay, brings tangible benefits:

-

Boosting Tourism and Trade: Tourists from partner countries can spend more easily, which in turn boosts revenue for Vietnam's tourism and related service sectors. At the same time, export businesses can receive payments from foreign partners more conveniently.

-

Enhancing Vietnam's Position: The development of a modern digital payment system integrated with international platforms will elevate Vietnam's position on the global financial map.

-

Strengthening International Cooperation: Cross-border QR payment agreements are an effective form of economic collaboration, helping to solidify relationships between nations.

Cross-border QR codes are no longer just a technology; they have become a powerful tool driving the global cashless economy. With the efforts of Fintech companies like 9Pay, Vietnam is firmly in this flow, helping to build a more seamless and efficient payment ecosystem that brings long-term benefits to the domestic and global economies.