The bank exchange rate is approaching 26,000 VND per USD

Analysts cite DXY recovery and rising forex demand in late March as firms stockpile materials amid supply chain risks.

On March 24, the State Bank of Vietnam (SBV) set the central exchange rate at 24,831 VND/USD, an 18 VND increase from March 21. With a ±5% trading band, today’s ceiling rate is 26,073 VND/USD, while the floor rate is 23,589 VND/USD. The reference exchange rate at SBV’s exchange bureau stands at 23,623-26,003 VND/USD (buy/sell).

Major commercial banks, including Vietcombank, VietinBank, and BIDV, adjusted their exchange rates three times during the morning session. By midday, Vietcombank raised its buying rate by 55 VND and its selling rate by 65 VND compared to the March 21 closing, now trading at 25,435 – 25,825 VND/USD. Similarly, BIDV increased both buying and selling rates by 65 VND to 25,465 – 25,825 VND/USD. VietinBank raised its rates by 97 VND, reaching 25,467 – 25,827 VND/USD.

Techcombank, VPBank, and Eximbank adjusted their USD rates by 80-90 VND per USD, with buying rates fluctuating around 25,470 - 25,452 VND/USD and selling rates ranging from 25,800 - 25,826 VND/USD.

On the black market, the USD is trading at 25,810 - 25,910 VND/USD, down 60 VND from the previous session.

At noon (Vietnam time), the USD Index (DXY) edged down 0.01% from the previous day but remained high at 104.131 points. The DXY rebounded after the U.S. Federal Reserve (Fed) indicated no rush to further rate cuts.

Recent U.S. economic data presents mixed signals. Consumer and business sentiment surveys point to an economic slowdown, exacerbated by government tariff policies and federal spending cuts. However, official employment and manufacturing statistics suggest that concerns over stagflation or recession may be overstated.

Last week, Fed policymakers lowered their 2025 U.S. growth forecast to its lowest level since 2022. Meanwhile, the OECD warned that U.S. trade policies could slow global economic activity. Key economic indicators, including U.S. manufacturing and services PMI data on Monday and PCE inflation data on Friday, will be closely watched for insights into the Fed’s next steps.

Analysts highlight the DXY recovery and rising foreign currency demand in late March as primary drivers of exchange rate pressure.

On March 6, the General Statistics Office reported a trade deficit of $1.55 billion in February 2025, marking the first deficit since May 2024. Consequently, the trade surplus for the first two months of 2025 shrank to $1.47 billion, a significant drop from the $5.13 billion surplus recorded in the same period of 2024.

This decline stems from weaker exports and rising imports as businesses continue stockpiling raw materials amid escalating supply chain disruptions.

Exchange rate pressure is expected to persist throughout 2025 as the U.S. dollar remains strong. President Trump’s tariff policies could heighten inflation risks, prompting the Fed to maintain a cautious stance on rate cuts.

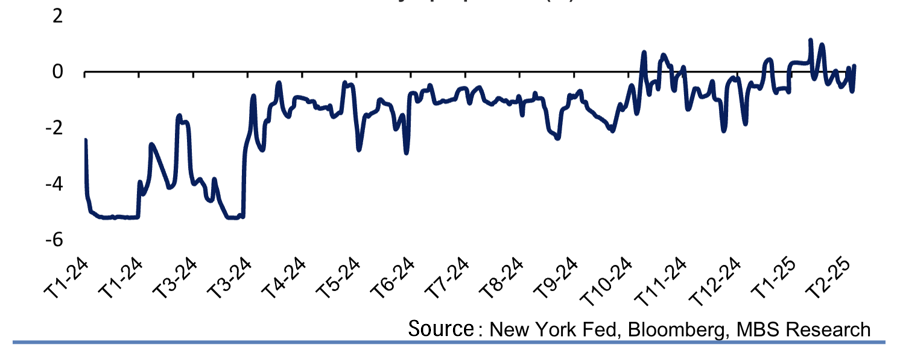

Overnight VND-USD Interest Rate Spread

However, analysts anticipate some support for the VND from a narrowing VND-USD interest rate spread. In early 2024, overnight USD interest rates exceeded VND rates by 1.6 - 5.2% per annum. By early 2025, this gap had narrowed to just 0.2 - 0.8%, with occasional instances where VND rates surpassed USD rates.

Source: vneconomy