Top 5 Best Payment Gateway for Small Business in Vietnam 2024

Are you looking for the best payment gateway for your small business? We've done the research and compiled a list of 5 payment gateways, based on factors such as ease of use and features.

Whether you're just starting out or you're looking to switch to a new payment gateway, we've got you covered. In this article, we'll take a closer look at each of the top 5 payment gateways, so you can choose the one that's right for your business.

1. Understanding about Payment Gateway

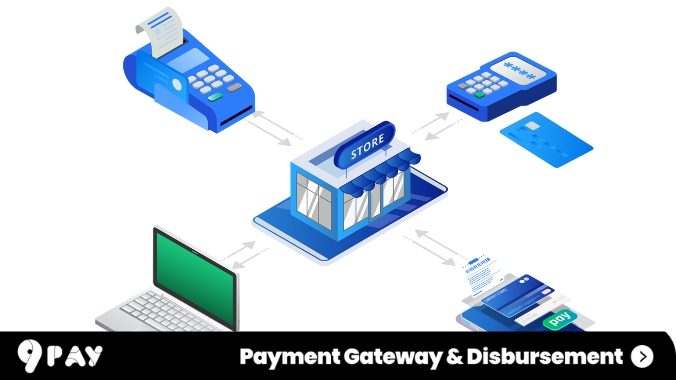

Payment gateways are merchant services that facilitate credit card or direct payment processing for businesses. They enable the acceptance and processing of both digital and in-person payments. When a customer wants to make a payment, they are directed to the payment gateway, where they enter their payment information.

The payment gateway then passes this information to the payment processor, which verifies the accuracy of the information and authorizes the transaction. The payment gateway then notifies your business bank account of the incoming funds, and the funds are transferred from the customer's bank account to your business account

2. Benefits of Using Payment Gateway for Small Businesses

Streamlined payment processing: Payment systems offer fast and automated payment processing, which can save you time and money.

Enhanced security: Payment gateways come equipped with robust security measures to protect your customers' sensitive data.

Increased customer trust: Offering secure payment options builds trust with your customers and encourages them to make purchases with you.

Seamless integration: Many payment systems seamlessly integrate with popular e-commerce platforms, making it easy to set up and manage payments.

3. 5 Best Payment Gateway for Small Businesses

Now let's dive into the seven best payment systems for small businesses, listed here in no particular order:

3.1. 9Pay Payment Gateway for small business

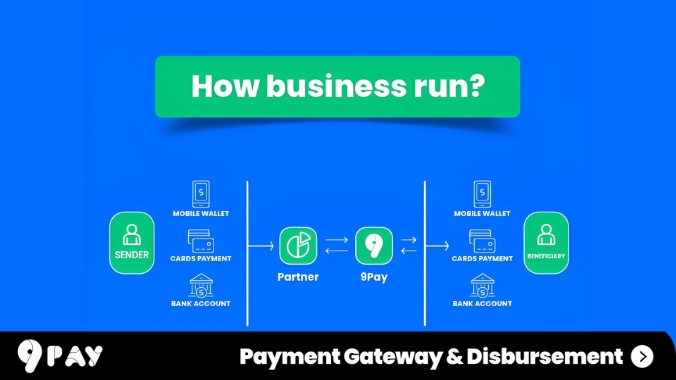

9Pay Payment Gateway is a leading payment gateway in Vietnam that offers a variety of payment solutions for small businesses. 9Pay is known for its low fees, easy-to-use interface, and fraud protection. 9Pay also offers a variety of features that are specifically designed for small businesses, such as:

- Accepting payments online, and through mobile apps

- Providing analytics tools to track sales and performance

- Supporting a variety of payment methods, including credit cards, debit cards, payment links, and e-wallets

Reasons why 9Pay is considered one of the best payment systems for small businesses in Vietnam:

Low fees: 9Pay offers some of the lowest fees in the market, making it a cost-effective option for small businesses.

Easy-to-use interface: 9Pay's interface is simple and straightforward, making it easy for businesses of all sizes to use.

Fraud protection: 9Pay offers a variety of fraud protection measures to help businesses protect themselves from fraud.

Support for multiple payment methods: 9Pay supports a variety of payment methods, including credit cards, debit cards, and e-wallets.

Global reach: 9Pay is a local payment gateway that can support cross-border payment and do settlement overseas to collect the money from Vietnamese End-users/Enterprises.

If you are looking for a reliable and affordable payment system for your small business in Vietnam, 9Pay is a great option to consider.

Contact us:

Hotline: 1900 88 68 32

Email: [email protected]

Read more: 9Pay is honored to be in TOP 5 Favorite Payment Channels at Vietnam Game Awards 2023

3.2. Adyen: The Omnicommerce Solution for Accepting Payments

Adyen is an omnichannel payment gateway that allows businesses to accept payments both online and in person. This makes it a great option for small businesses that operate in both brick-and-mortar and online environments.

(Source: Adyen)

Adyen also offers a wide range of features and integration options, making it a versatile payment solution for businesses of all sizes.

3.3. Stripe: The Supreme Payment Gateway for Small Businesses

Stripe is a popular payment gateway that is widely regarded as one of the best options for small businesses. It offers a wide range of features and integration options that are tailored to the specific needs of small businesses.

One of Stripe's key strengths is its seamless payment processing, which ensures that transactions happen quickly and easily. Stripe also offers a variety of security features to protect your customers' data.

(Source image: Stripe)

Integrating Stripe with your website or mobile app is simple thanks to its extensive integration options. Whether you're using a popular e-commerce platform like Shopify or building a custom website, Stripe provides the necessary tools to integrate payment processing seamlessly.

3.4. Square

Square is a payment platform that allows businesses of all sizes to accept payments in person, online, remotely, and manually. It has no monthly fees but charges a transaction fee of 2.6% plus 10 cents. This makes it a good option for small businesses that are looking for low processing fees and reliable service.

3.5. PayPal

PayPal is one of the oldest and most popular payment platforms available, making it a reliable choice for small businesses. It offers low processing fees, global availability, fraud protection, customer support, and easy accounting integrations. PayPal Payments Pro is a comprehensive option that enables businesses to process payments directly on their website.

(Source image: PayPal)

In the United States, transactions incur a fee of 2.9% plus 30 cents, while international transactions carry a fee of 4.4% plus a fixed fee. Small businesses requiring a payment platform with a global reach should consider PayPal Payments.

4. Factors to Consider When Selecting Payment Gateway

When selecting the best payment gateway for your small business, be sure to consider the following factors:

4.1. Reliability

Opt for a payment gateway with a solid track record to ensure the security of customer payment information and seamless payment processing for any type of transaction.

4.2. Customer support

Choose a payment gateway that offers excellent customer support, as indicated by positive reviews from other users. The availability of online help articles, phone support, and live chat can be beneficial.

4.3. Fees

Understand the associated fees for each payment gateway, including monthly costs, transaction fees, and any hidden charges. Compare the costs of online and in-person transactions, and evaluate which option fits your budget.

4.4. Ease of use

Select a payment system that is user-friendly, from integrating it into your website or shopping cart to accepting payments from customers. The installation process should not require extensive technical expertise.

4.5. Payment types supported

Ensure that the payment gateway supports the payment methods you plan to accept, such as credit cards, ACH, and debit card payments. Consider the seamless checkout experience for in-person visits, mobile payments, virtual terminals, and online transactions.

4.6. Integration options

Look for a payment gateway that offers various integration options, making it easy to add the system to your website, shopping cart, or other software. Check for compatibility with popular eCommerce platforms, CRMs, and accounting software programs.

4.7. Security

Prioritize a payment gateway that prioritizes security, offering robust features such as PCI compliance, encryption, and data tokenization to protect customer payment information. Ensure that your chosen system meets necessary fraud prevention requirements.

4.8. Scalability

Select a payment gateway that can grow alongside your business, accommodating increased transaction volumes without sacrificing transaction speed. Look for scalable options and consider the ability to customize features to fit your specific needs.

4.9. User reviews

Before making a final decision, read user reviews to gain unbiased insights into the payment gateway performance. Focus on reviews related to customer support, ease of use, security, and value for price.

By evaluating your needs, budget, and the features of each payment system, you can make an informed decision that best suits your small business. Remember, the right payment system can significantly impact your business's growth and success.

5. FAQ

5.1. What is a payment gateway?

A payment gateway is a service that allows businesses to accept payments from customers through their websites or mobile applications. It acts as a secure bridge between the customer's payment method (such as a credit card or digital wallet) and the merchant's bank account, facilitating the authorization and processing of transactions.

Here is how a payment gateway works:

- Step 1: Customer enters their payment information on the merchant's website or mobile app.

- Step 2: Payment information is encrypted and sent to the payment gateway.

- Step 3: The payment gateway validates the payment information and sends it to the merchant's bank.

- Step 4: The merchant's bank authorizes the payment and sends the funds to the merchant.

- Step 5: The payment gateway sends a notification to the merchant and the customer, confirming the transaction.

5.2. Can I use a payment gateway for both online and in-person transactions?

Yes, many payment gateway offers the capability to accept payments both online and in-person, providing a versatile solution for small businesses.

5.3. Can I accept payments directly on my website?

Yes, payment gateway like 9Pay enables businesses to process payments directly on your website, providing a seamless checkout experience for customers.

Choosing the right payment gateway for your small business is essential for streamlining your payment processing and providing a seamless experience for your customers. When evaluating payment systems, consider factors such as reliability, customer support, fees, ease of use, payment types supported, integration options, security, scalability, and user reviews.

Take the time to explore your options and choose a payment gateway that meets your specific needs and budget. By implementing a payment gateway, you can improve your customer experience and streamline your payment processes.

5.4. How do I pay electronically in Vietnam?

Electronic payment methods are widely used and accessible in Vietnam. Here are common ways to pay electronically in the country:

Credit and Debit Cards:

Credit and debit cards are commonly accepted in urban areas and major establishments. Visa and MasterCard are widely used, but it's advisable to check card acceptance with specific vendors.

Mobile Wallets:

Mobile wallets are popular in Vietnam, allowing users to link their bank accounts or credit/debit cards to a digital wallet. Common mobile wallet providers include 9Pay E-wallet, MoMo, ZaloPay, and ViettelPay.

Internet Banking:

Internet banking is a convenient way to manage and make electronic payments. It enables users to pay bills, transfer money, and perform various financial transactions through the bank's online platform.

QR Code Payments:

QR code payments have gained popularity. Payment apps and mobile wallets often generate QR codes that users can scan to make payments or receive funds.

Related articles