Virtual Account: Definition, How It Work? and Benefits for Your Business

In this article, 9Pay will explain what a virtual account is, the different types of virtual accounts and the benefits that virtual accounts bring to your business

In today's fast-paced business environment, efficiency and convenience are paramount. Virtual accounts have emerged as a game-changer in the realm of online payments, collection, and disbursement services, offering businesses a streamlined and cost-effective solution. These accounts provide an affordable and secure way to manage and process payments, delivering countless benefits in transforming your business.

1. What is a Virtual Account?

A virtual account is a unique and dedicated account number associated with a traditional bank account. It functions as a sub-account, enabling businesses to segregate funds and track transactions for specific purposes. Virtual accounts are dynamic or static, each serving distinct needs. Let's take a look and explore their features.

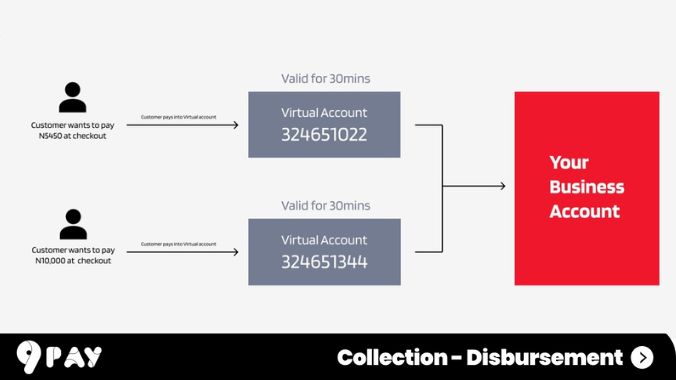

1.1. Dynamic Virtual Account

Dynamic virtual accounts are temporary accounts that are automatically generated for each transaction. Each account has a unique identifier, allowing businesses to track payments and reconcile transactions with ease. This feature is particularly useful for businesses that handle a high volume of transactions, such as e-commerce merchants or online marketplaces. Dynamic virtual accounts streamline payment processing and reconciliation, reducing the risk of errors and enhancing efficiency.

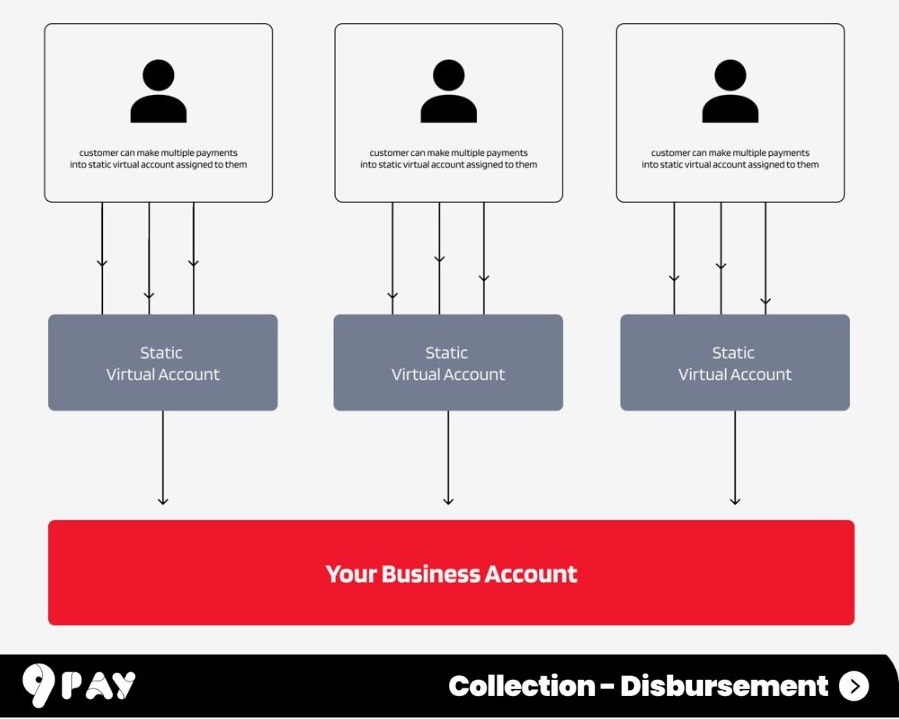

1.2. Static Virtual Account

Static virtual accounts, on the other hand, are permanent accounts that can be used for recurring payments or specific customers. These accounts are ideal for businesses that have long-standing relationships with their clients or require regular payments for services or subscriptions.

2. How do Virtual Account work?

The operation of virtual accounts is relatively straightforward. When a customer makes a payment, they are provided with a unique virtual account number. This number is then linked to the merchant's designated bank account, allowing the funds to be transferred securely. The payment is then automatically reconciled, eliminating the need for manual data entry and reducing the risk of errors.

Also read: 9Pay Payment Solution for Global Businesses in Vietnam

3. Benefits of Virtual Account for Your Business

Virtual accounts bring many benefits to growing your business:

3.1. Automated reconciliation

One of the main advantages of a virtual account is automatic payment adjustment. Virtual accounts eliminate the need for manual reconciliation, saving time and resources while reducing the risk of errors. This automation streamlines payment processing and provides businesses with real-time insights into their financial transactions.

3.2. Lower transaction fees

Virtual accounts often come with lower transaction fees compared to traditional payment methods, such as credit cards, bank transfers or payment gateway. This cost-saving can significantly impact your business's bottom line, especially for high-volume transactions.

3.3. Making payments at any time

Virtual accounts allow customers to make payments at any time, regardless of business hours or geographical location. This flexibility enhances customer convenience and can boost sales by reducing the likelihood of abandoned purchases due to inconvenient payment options.

3.4. Serving various types of transactions

Virtual accounts can accommodate a wide range of transaction types, including one-time payments, recurring payments, and split payments. This versatility makes them a suitable payment solution for businesses of all sizes and industries.

3.5. Improved customer experience

Virtual accounts contribute to an improved customer experience by offering a secure, convenient, and efficient payment process. Virtual accounts facilitate faster and more secure transactions, enhancing customer satisfaction.

4. 9Pay - The Best Payment Solutions in Vietnam for Foreign Partners

9Pay Virtual Account enables you to manage all of your financial operations from one place. This payment solution empowers you to oversee multiple virtual accounts, facilitating seamless payouts and enhancing your overall float management.

In addition, 9Pay's virtual account solution also gives you access to detailed payment reports, roviding useful information and data on payment trends, customer behavior and payment preferences. This data helps you manage cash flow more effectively, better understand your customers, and make more informed decisions for your business.

In conclusion, virtual accounts have revolutionized the way businesses manage and process payments. By adopting virtual accounts, businesses can streamline operations, reduce expenses, and elevate customer experiences to new heights. Embrace the power of virtual accounts and propel your business towards a future of seamless and secure financial transactions.

Related articles

9Pay Disbursement Service: Convenience and Efficiency

International E-wallet: Fast, safe and secure cross-border payment solution