Key takeaways from the 2023 payment market

As we reflect on the tumultuous journey of the payment market in 2023, several key insights emerge, shedding light on the dynamic forces shaping the fintech landscape.

Amidst the volatility that characterized much of the year, the resilience and strategic shifts witnessed in the payment sector offer valuable lessons for stakeholders across the fintech ecosystem.

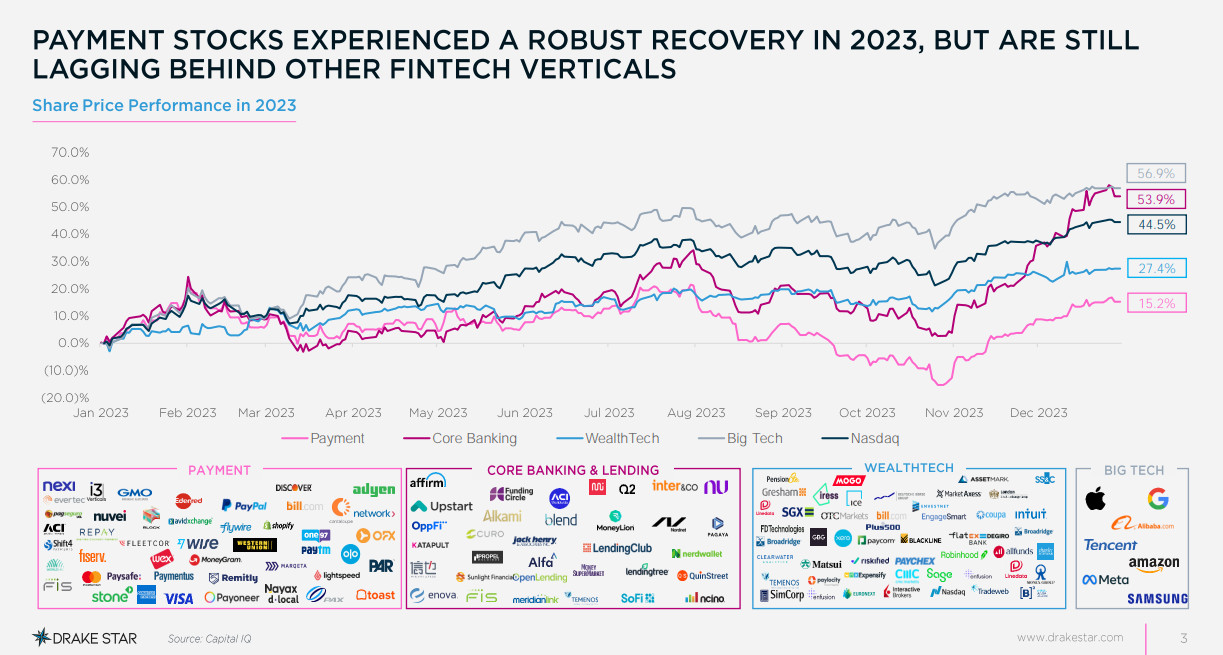

1. A year of volatility and resilience for payment stocks

The payment market has experienced its fair share of ups and downs throughout 2023, with payment stocks demonstrating significant volatility. Notably, the fourth quarter saw a remarkable rebound, signaling robustness within the sector. Despite these gains, payment stocks have lagged behind their counterparts in other fintech verticals, suggesting a nuanced landscape with specific challenges and opportunities.

2. Dominance of strategic buyers in M&A deals

Strategic buyers have been the driving force behind payment market consolidations, accounting for a staggering 72% of total payment M&A deals in 2023. This trend underscores the strategic importance of payment systems within the broader financial technology landscape and the value placed on established, scalable solutions.

3. Shift towards mature assets

In a significant development, the focus of acquirers has shifted towards more mature assets. This strategic pivot is underscored by the massive increase in the average deal value, which surged to $712 million in 2023 from $219 million in 2022. Such investments reflect a confidence in the stability and growth potential of mature payment solutions, marking a shift in investment priorities within the sector.

4. Payment's substantial role in Fintech M&A

The payment sector accounted for 39% of total fintech M&A activity in 2023, highlighting its pivotal role in shaping the fintech landscape. This significant contribution underscores the critical importance of payment solutions in the evolution and expansion of financial technologies.

5. Big Tech’s strategic emphasis

Big technology companies are increasingly focusing on enhancing their footprint in the payment sector through global and local partnerships, along with a strong emphasis on security measures. This strategic orientation reflects a recognition of the payment sector's critical role in the broader digital economy and the potential for growth through collaboration and technological advancement.

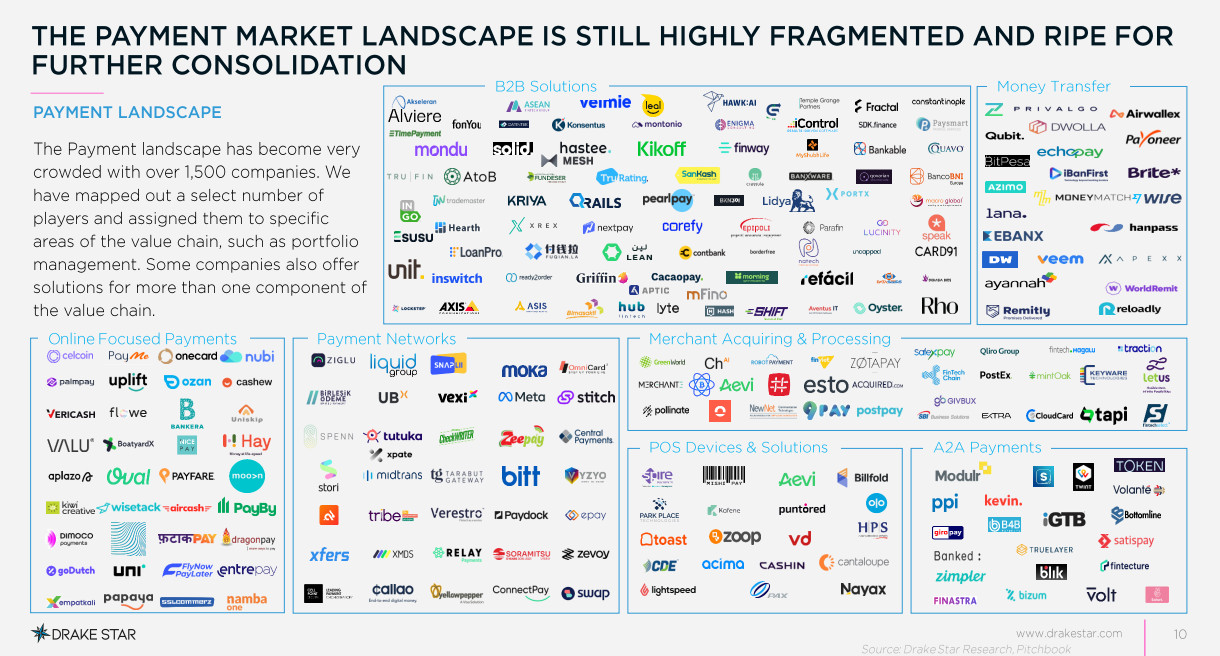

6. The path ahead: Fragmentation and consolidation

Despite the progress and strategic shifts, the payment market remains highly fragmented, suggesting ample room for further consolidation. This environment presents both challenges and opportunities for innovation, competition, and strategic partnerships, shaping the future trajectory of the payment sector.

Within this context, 9Pay, a payment service provider operating both in Vietnam and globally, is highlighted as a notable entity. The report underscores how this environment of fragmentation presents a dual-faced scenario of challenges and opportunities. For companies like 9Pay, it opens avenues for innovation, fosters competition, and encourages the formation of strategic partnerships. These dynamics are pivotal in shaping the future trajectory of the payment sector, where entities like 9Pay are positioned to potentially leverage their operations and strategic initiatives to navigate through the complexities of the market, driving forward both growth and integration in a landscape ripe for consolidation.

As we look towards the future, the lessons learned in 2023 will undoubtedly influence strategic decisions and innovation pathways within the payment market. The sector's resilience, strategic realignments, and the ongoing impact of technological advancements set the stage for an exciting and transformative journey ahead.